how to lower property taxes in florida

This can get confusing so heres an example. File a Tax Appeal.

How Can I Minimize My Property Taxes In Florida Florida Homestead Check

TAX SAVING TIP 1.

. Reduce Your Property Taxes. Avoid any renovations or improvement work that could. That exemption would apply to the value of the property between 100000 and 150000.

How Can I Minimize My Property Taxes In Florida. Make sure that your homes initial valuation is as low as. The most significant potential.

In Florida all counties must keep records of all existing properties. How to lower property taxes in florida. - Effective real estate tax rate.

Florida is ranked 18th of the 50. If you are not sure I recommend. A tax appeal is the last resort for homeowners who want to lower their property taxes.

Feasible Options to Reduce Your Property Taxes in Florida 1- Look at Real Property Information in Detail. Ron DeSantis won re-election in Florida cementing Republicans power in a state that was once a key battleground. It frees the first 25000 of the homes assessed value from all property taxes and it exempts another 25000 from non-school property taxes.

Be sure and file for. How can I lower my property taxes in Florida. You must have lived in the same home for at least 25 years.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. TAX SAVING TIP 2. How Can I Minimize My Property Taxes In Florida.

Polls Closing Polls just closed in 19 states and. 3309 Northlake Blvd Suite 105 Palm Beach Gardens FL 33403. To put that figure into perspective for a typical homeowner the savings would lower a monthly mortgage payment by about 68.

Floridas median income is 53595 per year so the median yearly property tax paid by Florida residents amounts to approximately of their yearly income. There are a few other things you can do to lower your property tax bill or get help paying your property tax in Florida. The market value of the property must.

Amendment 3 still fell short of the margin. There are a few other exemptions that you might be able to select if one or some of the following conditions apply. At least one homeowner must be 65 years of age or older as of January 1st.

It would not apply to school district taxes. This exemption does not apply to school district taxes. - Floridas median home value.

Florida by the numbers. An additional 25000 applies to the amount of your homes value that is over 50000 and up to 75000. - Annual taxes on Floridas.

TAX SAVING TIP 1. Property Tax Appeals for Palm Beach County Tel. There are also a number of property tax exemptions to consider and research when attempting to reduce the cost of property taxes on your home.

While you wont be able to contest the tax rate you will be able to. - Annual taxes on 2175k home. Make sure that your homes initial valuation is as low as possible.

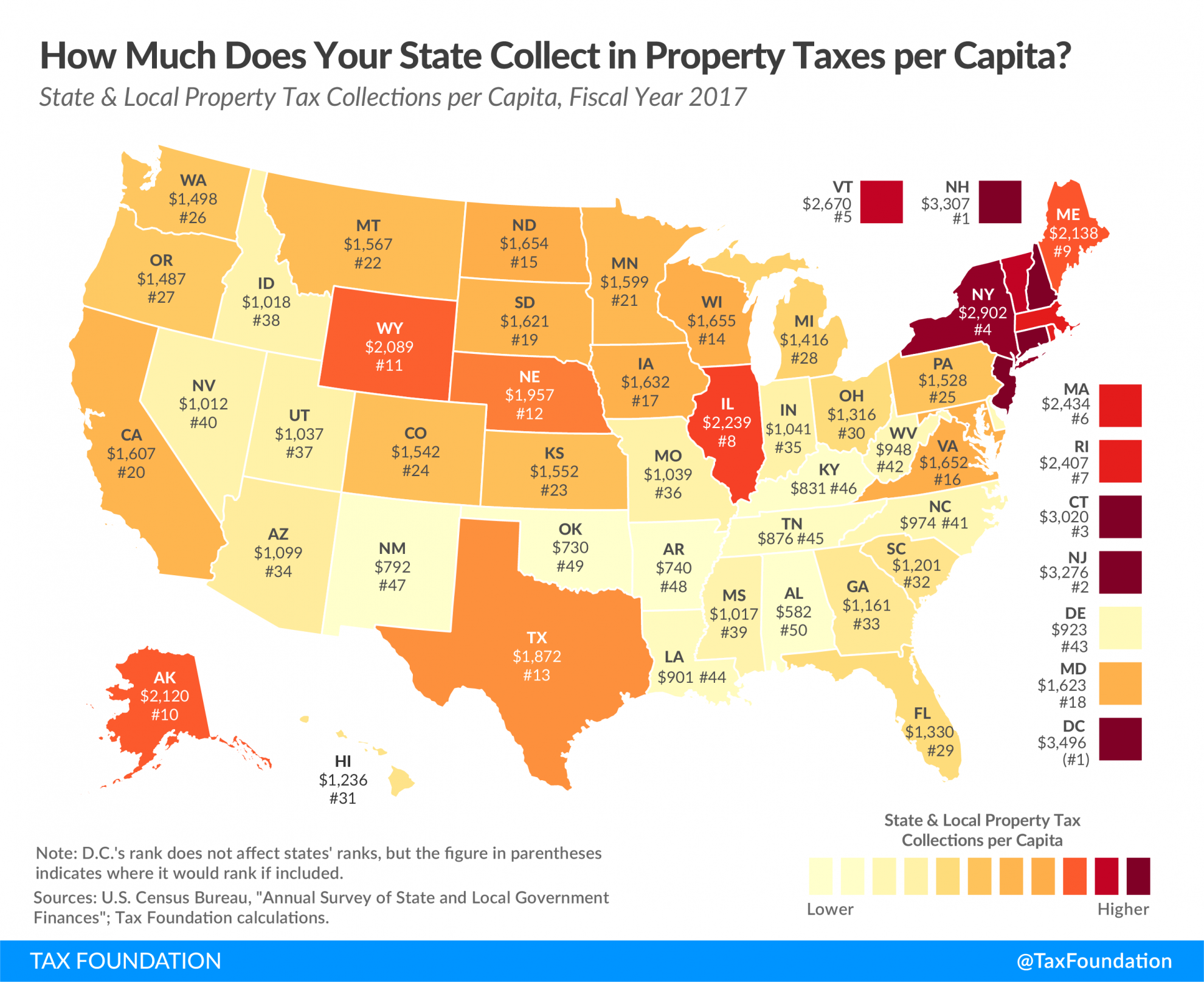

How Much Does Your State Collect In Property Taxes Per Capita

Where Are The Lowest Property Taxes In Florida Mansion Global

Arizona Property Taxes Are Much Lower Than In California Florida Or Texas Arizona Real Estate Notebook

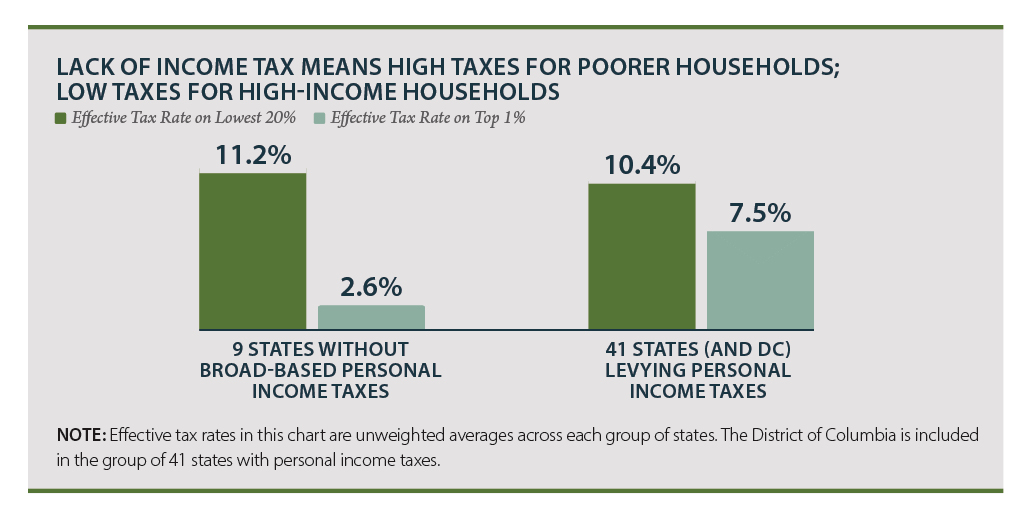

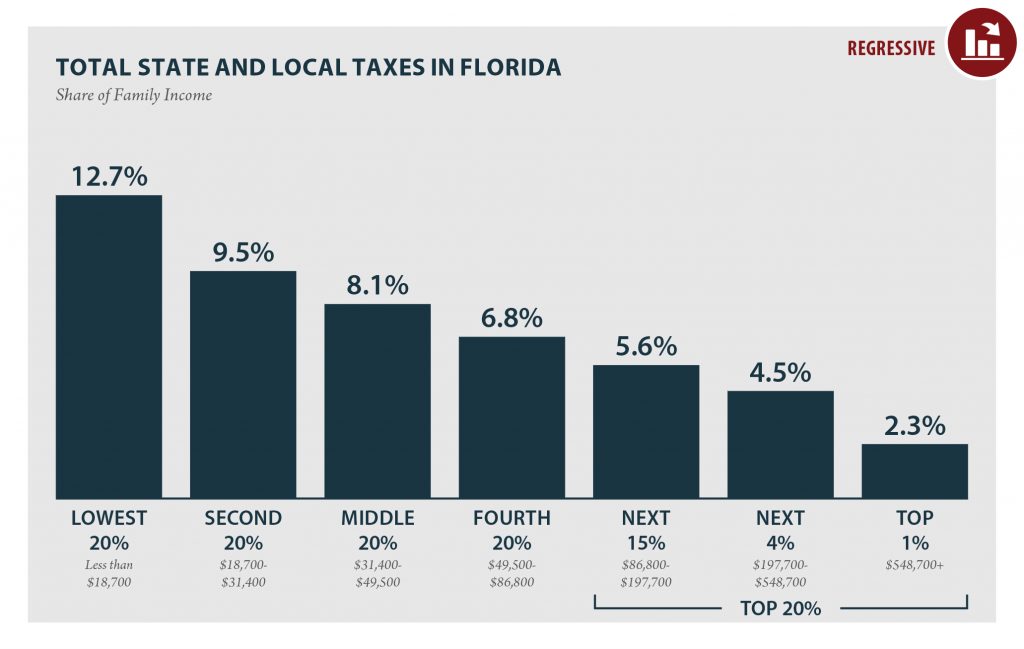

Low Tax For Whom Florida Is A Low Tax State Overall But Not For Families Living In Poverty Itep

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

Are There Any States With No Property Tax In 2022 Free Investor Guide

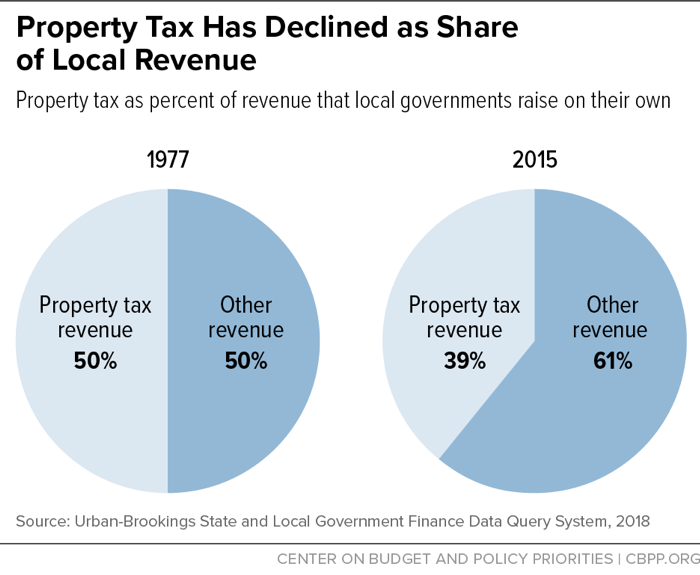

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Columbia County Tax Collector Proudly Serving The People Of Columbia County

Tangible Personal Property State Tangible Personal Property Taxes

Top 5 Property Tax Firms In South Florida Luxury Property Care

How To Lower Your Property Taxes If You Bought A Home In Florida

How To Lower My Property Taxes In Florida Learn More

2022 Property Taxes By State Report Propertyshark

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

How To Lower Your Property Taxes If You Bought A Home In Florida

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation